tucson sales tax rate 2019

Average Sales Tax With Local. The Pima County sales tax rate is.

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

The Arizona sales tax rate is currently.

. 4 rows The current total local sales tax rate in Tucson AZ is 8700. The minimum combined 2022 sales tax rate for Tucson Arizona is. The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87.

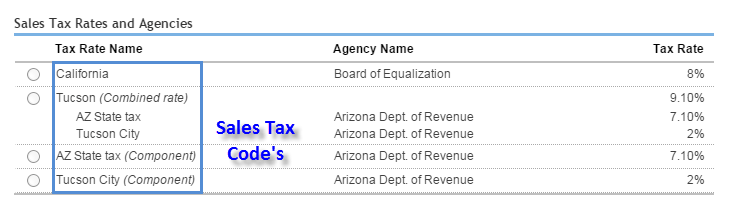

Sales Tax Increase Effective October 1 2019 Methods of Notification. If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction. You can print a.

Prior to January 2019 commercial projects that met the following three requirements were considered alteration. SOUTH TUCSON Ariz. A yes vote supports extending an existing additional sales tax of 05 for 10 years with revenue dedicated to residential street repairs thereby maintaining the total sales tax rate in Tucson at 87.

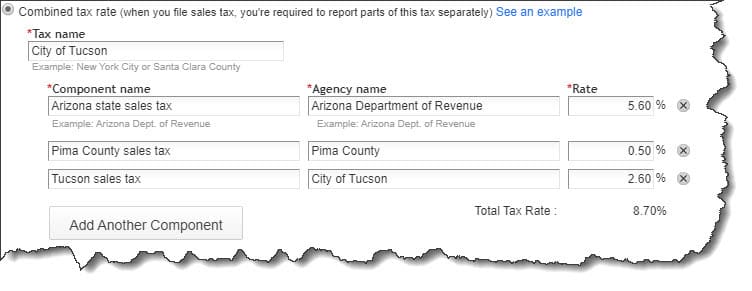

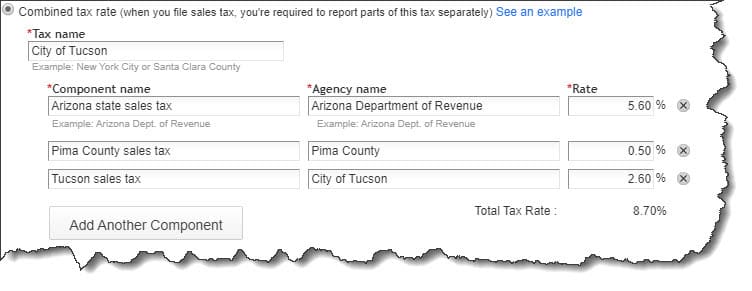

Scottsdale AZ Sales Tax Rate. Tempe AZ Sales Tax Rate. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

The Arizona state sales tax rate is currently. Use Tax From Inventory. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities.

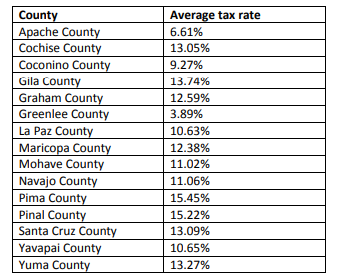

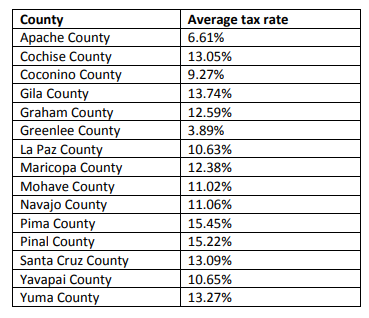

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. What is the sales tax rate in Tucson Arizona. Tempe Junction AZ Sales Tax Rate.

If you do not separately itemize the tax you may factor. This is the total of state county and city sales tax rates. Did South Dakota v.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. 1242019 94039 AM. The 2018 United States Supreme Court decision in South Dakota v.

Businesses with multiple locations or business lines can opt to license. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. The County sales tax rate is.

Utilities and communications are each currently taxed 5 percent and retail sales 45 percent by South Tucson the State charges an additional 61 percent. The arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Arizona has state sales tax of 56 and.

19-01 to increase the following tax rates. A 1500 refrigerator purchased in Marana where the sales. Surprise AZ Sales Tax Rate.

This is the total of state and county sales tax rates. 1 TPT News and Updates Newsletters which is placed on the website social media and GovDelivery every 20th or so of the. Sales tax calculator of 85710 tucson for 2021.

The minimum combined 2022 sales tax rate for Pima County Arizona is. The sales tax jurisdiction name is Arizona which may refer to a local government division. Public Utility Right of Way.

6 rows The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and. A no vote opposes extending an existing. The current total local sales tax rate in tucson az is 8700.

Retail Sales 017 to five percent 500 Communications 005 to five and one-half percent 550 and Utilities 004 to five and one-half percent 550. Public Utility Additional Utility 104. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location. For example retail food sales for home consumption are taxed the lowest at 15 percent but only generated 83359 in six months between July 2018 and January 2019. The Tucson sales tax rate is.

Wayfair Inc affect Arizona. Three cities follow with combined rates of 10 percent or higher. KOLD News 13 - The City of South Tucson city council narrowly approved a measure increasing the citys sales tax rate to 11 percent on Monday leaving citizens and local business owners scrambling to cope.

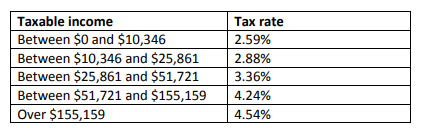

Public Utility Additional Communications 105. Groceries and prescription drugs are exempt from the Arizona sales tax. You will need to apply for an Arizona Transaction Privilege Tax.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Sierra Vista AZ Sales Tax Rate. Tucson Proposition 411 is on the ballot as a referral in Tucson on May 17 2022.

Local General Sales Tax AZ State Sales Tax Globe 330 560 Miami 350 560 All tax rates subject to change without notice. There is no applicable special tax. What is the sales tax rate in Pima County.

If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. SALES TAX INFORMATION FOR TUCSON ARIZONA SALES TAX FORMS The sales tax rate for Pima County is currently 61. San Tan Valley AZ Sales Tax Rate.

Sun City AZ Sales Tax Rate. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. Prescott Valley AZ Sales Tax Rate.

Tucson AZ Sales Tax Rate.

Mg Hs Vs Tucson Vs Sportage A Comparison Sportage Kia Sportage Hyundai Tucson

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

What S The Arizona Tax Rate Credit Karma Tax

Property Taxes In Arizona Lexology

State And Local Taxes In Arizona Lexology

Merchants Rio Nuevo Downtown Redevelopment And Revitalization District Tucson Az

2021 Arizona Car Sales Tax Calculator Valley Chevy

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

How To Process Sales Tax In Quickbooks Online

5 Things You Need To Know About Sales Tax In Quickbooks Online

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Sales Tax Rates In Major Cities Tax Data Tax Foundation

State And Local Taxes In Arizona Lexology